Require 3 benefits from your advisor:

* Evidence that their investment approach delivers consistent superior performance;

* Assurance that comes from a trustworthy advisor who understands your concerns, and puts your interests first;

* Peace of mind that comes from knowing you made the right decision about who should manage your wealth.

Grow Your Money

Invest With Confidence

The Tides Portfolio

2012 - 2021

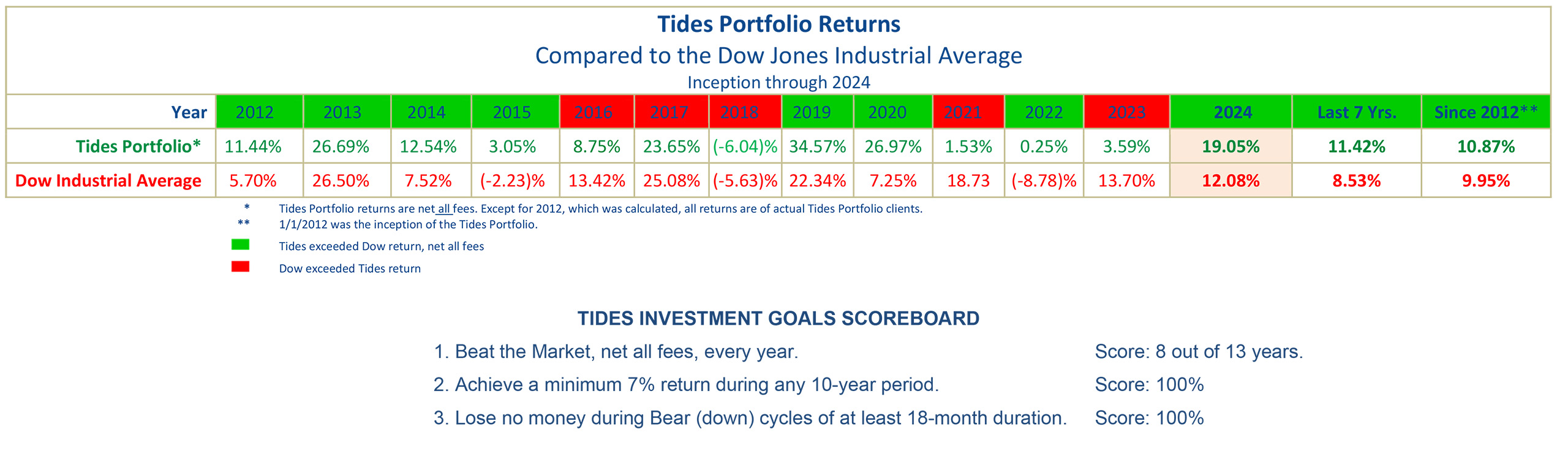

14.28% average compound annual growth rate.

0% realized loss during Bear cycles.

Invest With Confidence

The majority of financial advisors,

as well as the 100,000 private foundations in the U.S.,

underperform the market.

The Tides Portfolio has outperformed the Dow

8, out of 13, years since inception (2012).

Lower Your Risk

Outperform the Market

Invest With Confidence

TO CONTACT US ...

ROSS FINANCIAL GROUP

64 66th Place • Long Beach CA 90803 • 562 438.1000